According to Consumer Sentiment Index (CSI) data from Criteo (NASDAQ: CRTO) – the commerce media company – over eight-in-10 (81%) UK consumers will shop for presents online this year with 60% identifying the time saving aspect of shopping online as their main reason.

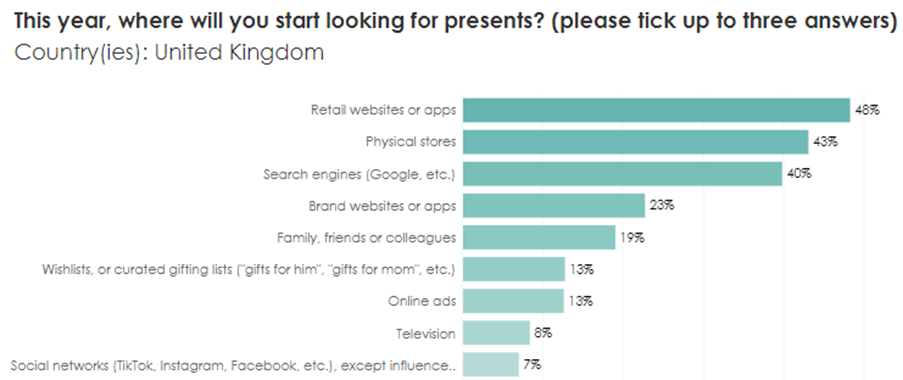

The research found that in-store shopping could fall by 11% year-on-year (81% to 70%), but the good news for retailers is that half (48%) of UK shoppers say they start looking for presents on retail websites or apps, closely followed by physical stores (43%).

While search engines such as Google come a close third (40%), channels which usually see high festive spend such as TV (8%) and social networks (7%) fall low on the list of where consumers first start looking for presents.

Generationally, millennials will be among the greatest contributors to online sales this season, with 37% planning to increase their online spending vs 2021, which compares to 21% of older shoppers. This contrasts with 2021, when the Boomer generation surpassed millennials (45% vs 42%), which reflected the concerns from the time around shopping in-store.

Perhaps one of the most surprising findings was that at any time during the year, at least 35% of UK shoppers are thinking about holiday gifts. Survey respondents were also 11% more likely to say they get good present ideas in-store than online.

“This may be one contributing factor as to why there’s such a strong pull towards retailer properties”, said Andy Stephen, managing director UK, Retail Media, Criteo. “It’s clear consumers have been planning gifts for loved ones throughout the year, so as the festive season approaches, they already know the products they’re after and will go directly to the places they can make a purchase. For this festive season, advertisers should be leaning into these channels.

“In the same way retailers inspire shoppers in-store with eye-catching displays and new product demonstrations, they can help shoppers reconnect with the specific products and brands they care about online. Through retail media, many are also now able to make relevant recommendations for complementary goods through sponsored product listings and digital display, increasing basket size and order value. It represents a rare ‘win-win-win’ this holiday season, driving conversions for brands, revenue for retailers and quicker, seamless experiences for shoppers.”