Charlotte Monk-Chipman, Marketing Director, ReBOUND

With Europe’s shop doors reopen after a long hiatus, there are hopes that stores and warehouses currently bursting with unsold fashion items may begin to empty. However, many are also conscious that plenty of excess stock still lurks in the homes of their consumers. Across lockdown, 42% of retailers extended their return windows and even Amazon amended its policy to offer consumers additional time to send goods back. As bricks and mortar locations reopen, those brands eager to offload stock are already seeing the beginning of a flood of items coming back the other way. Monday 29th June recorded the highest number of return registrations we’ve ever seen in five years of operation, even higher than the rates typically seen after Black Friday.

On top of this, there are also signs that many shoppers who purchased online out of necessity during lockdown may stick with ecommerce, with two in five vowing to shop online more even after shops open their doors. While marketers may understandably be focused on how to sell their way out of this excess stock era, they should also consider how shifts in customer attitudes and shopping habits will fundamentally change returns – and how this evolution could end up being a boon for ecommerce marketing.

Learn To Cherish Returns

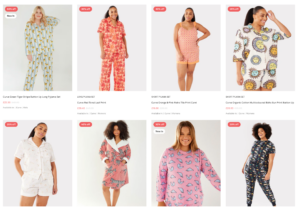

It’s high time brands made their peace with returns – not least because they’ll likely see much more of them. Online fashion sales typically generate a 30% return rate compared to instore’s 10%. The instore experience will likely be quite a different experience for months to come, with restricted entry and potentially limited changing rooms, so it is only to be expected that a significant proportion of customers will shop online.

Brands have been concerned about rising return rates for some years. However, it generally costs a brand a similar amount to process four returned items as one, so a customer who buys eight items and only keeps five is still more profitable than a shopper who buys two products and sends one back.

We also see that shoppers who return in high amounts but stay with the same brand often see their returns per order decline over time – they become better at identifying their preferred sizing, fabrics and general fashion sense, so decrease the number of returns they make, all while remaining loyal to the brand.

Harnessing Returns To Sell

The returns process provides a fantastic opportunity for customers to feedback invaluable information such as concerns around incorrect sizing, misrepresentative product images and unclear item descriptions. But in some cases, marketers are their own worst enemy. Conversion tactics to drive sales can lead to impulse buys and ‘basket fillers’ which are only ever purchased with the intent to return.

It is likely that this will only be exacerbated as marketers attempt to ramp up sales to shift excess stock. This obsession with continuously prompting purchases by flaunting flash sales, endless in-session upsells and multibuy offers encourages shoppers to buy first and choose later. This can often lead to buyer’s remorse and a larger return order.

However, rising return rates present an opportunity for marketers to reshape how their organisations approach returns. Currently, many brands simply include printed labels in outbound boxes, meaning the first they know about an item on its way back is when they open it. Furthermore, when prompted with a multiple-choice checklist of reasons for return, most consumers will tick ‘wrong size’ simply for ease – even when the item may be damaged or may not resemble its online imagery.

Prompting consumers to register and process their returns online instead instantly offers an opportunity to prepare for incoming items. This offers a far more efficient supply chain that doesn’t become overwhelmed at busy periods such as Christmas. More importantly, it gives more space for customers to type precisely why they are making a return.

This affords chances for marketers to sell more in the long run, producing data that can be harnessed to personalise the experience for individual shoppers but also optimise the online browsing experience more broadly. Seeing a tide of returns for one specific dress? You can check whether customers are saying that the photos are unrepresentative and adapt the product display. Experiencing huge ‘wrong fit’ returns? Adapt the item description sizes accordingly and play for that keep instead of just the sale.

The changes brands are experiencing provides the ideal time for marketers to stake a claim to the returns process, instead of passing it off as a logistics issue. Harnessing returns data to play for the keep rather than the sale will enable marketers to sell more in the long run and chip away at the mountain of excess stock – rather than watching it grow.